Customer churn is a term often used in the SaaS world, but what does it actually mean?

Simply put, churn is the rate at which customers are lost. These are customers that have canceled your service and aren’t coming back. It can be calculated for individual customers (B2C) or for an entire company (B2B). Four different types of churn are commonly measured: customer churn, revenue churn, gross churn rate, and net churn rate. Let's take a closer look at each type.

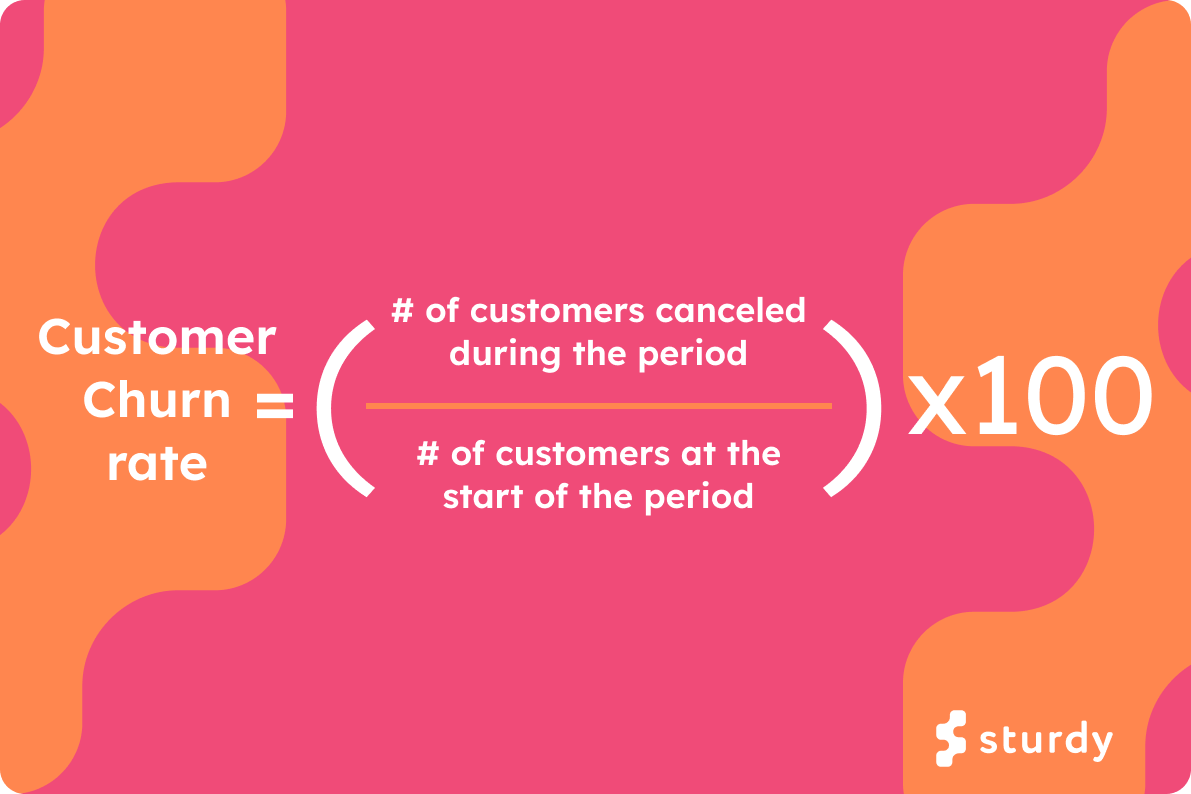

Customer churn is the most commonly used type of churn. It is the percentage of customers that stopped using your company's products or services during a specific time frame. You can calculate your customer churn rate by dividing the number of customers you lost during that period — say a quarter — by the number of customers you had at the beginning of that period.

Let’s pretend for a moment that you work on the growth team at SaaS.io, a new (you guessed it) SaaS startup. Over the last few months, SaaS.io has continued to grow hand over fist with little to no customer churn. However, customer acquisition has begun to slow, and your boss is asking you to calculate the customer churn rate in October. This equation is relatively straightforward. At the beginning of October, Saas.io had 54 customers. However, by the end of the month, two had churned. That means your customer churn rate in the month of October was 3.7%.

1. Total customers at the beginning of a period: 54

2. Number of customers lost in period: 2

3. Customer Churn Rate = (2/54)*100 = 3.7% (that is a great number, by the way)

Revenue churn is similar to customer churn, but instead of measuring customers leaving the company, it measures the amount of revenue lost due to customers who have left or downgraded their plans. To calculate revenue churn, divide the total amount of revenue lost in a certain period by the total revenue at the beginning of that period.

If we head back to our SaaS.io example, it’s important to note that the October revenue churn is much scarier than the customer churn. Yes, only two customers churned, meaning there was a 3.7% customer churn rate. However, one of those customers (Customer 2) accounted for 11% of MRR (monthly recurring revenue). Customer 1 generated only $6,000 in MRR, whereas Customer 2 generated $22,000 MRR. That means that at the beginning of October, SaaS.io’s MRR was $200,000. By the end of October, the revenue churn was .14.

1. Total revenue at the beginning of a period: $200,000

2. Net revenue lost in period: $6,000 + $22,000 = $28,000

3. Revenue Churn Rate = $28,000/$200,000 = .14

The Gross churn rate takes into account both customer and revenue churn. It measures the total number of customers and revenue lost in a certain period, divided by the total number of customers and revenue at the beginning. This gives an overall picture of how much business is lost in a given time frame.

If we apply this to SaaS.io, the MRR for October was $200,000, and users canceled $28,000 worth of contracts. That means the gross churn rate will be 14%

1. Total revenue at the beginning of a period: $200,000

2. Net revenue lost in period: $6,000 + $22,000 = $28,000

3. Gross Churn Rate = ($28,000/$200,000) x 100% = 14%

Net churn rate considers both customer and revenue churn. However, it also includes new customers and expansion revenue acquired in a certain period. Expansion revenue is the additional revenue you generate from existing customers through upsells, cross-sells, or add-ons. That’s why net revenue churn gives an overall picture of how much business is being gained or lost in a given time frame.

A month has passed since those two customers, and 14% of gross MRR was lost. Saas.io is currently at $172,000 MRR in November, as no additional sales have been made. Unfortunately, November has also seen $12,000 in contract losses. Luckily for Saas.io, a few existing customers have upgraded their plans, generating an additional $10,000 in revenue. Your boss asks you what the net churn rate for November is. First, you must subtract the customer upgrade revenue from the revenue lost in downgrades and cancellations. Then, divide that number by the revenue at the beginning of November.

1. Total revenue at the beginning of a period: $172,000

2. Net revenue lost in period: $12,000 - $10,000 = $2,000

3. Net Churn Rate = $2,000/$172,000 = 1.1%

At the beginning of this post, we noted that four types of churn could be measured. That isn’t entirely true, so here’s a bit of a bonus round. SaaS angel investor, Dave Kellogg argues that the leaky bucket equation “should always be the first four lines of any SaaS company’s financial statements.” Kellogg continues, “I conceptualize SaaS companies as leaky buckets full of annual recurring revenue (ARR). Every time period, the sales organization pours more ARR into the bucket, and the customer success (CS) organization tries to prevent water from leaking out”.

Kellogg defines the leaky bucket equation as “Starting ARR + new ARR - churn ARR = ending ARR”.

If we apply this to our Saas.io example, we can determine that the starting ARR in the fourth quarter (Q4) of 2022 was roughly $400,000. The new ARR in Q4 ‘22 was $56,000, and the Churn ARR in that same time period was $45,000. In other words:

1. Total starting ARR: $400,000

2. New ARR: $56,000 & Churn ARR: $45,000

3. Ending ARR = $400,000 + $54,000 - $45,000 = $409,000

Churn is an important metric to track for any SaaS company, as it can be used to identify trends, measure loyalty, and assess the effectiveness of customer retention strategies. Calculating churn rates can help companies identify which customers are more likely to leave and which types of customers are the most valuable. By understanding churn, businesses can take steps to improve customer retention and keep their business running smoothly.

.png)

When I started my first SaaS company, I had a standing meeting on my calendars every week to read random support tickets (random is the crucial word, by the way). Reading tickets was always illuminating and often painful. One of our learnings was a churn risk called "New Sheriff."

In any business, customer churn—or the percentage of customers who stop using your product or service—is inevitable. Cancellations happen. But that doesn't mean you should just roll over and accept it. There are things you can do to decrease customer churn and protect what is arguably the most important aspect of revenue — the longtail subscription revenue of your customer accounts. Let's take a look at the seven most effective strategies for decreasing customer churn.